Some drivers only purchase car insurance because it is mandatory. As a result, they tend to look for the cheapest car insurance when shopping for this insurance. If you also look for the most affordable auto insurance, you must learn the tricks on how to find the cheapest car insurance.

Finding cheap car insurance can be difficult at times because many factors affect insurance rates. However, it doesn’t mean that you cannot find cheap car insurance and save money on car insurance.

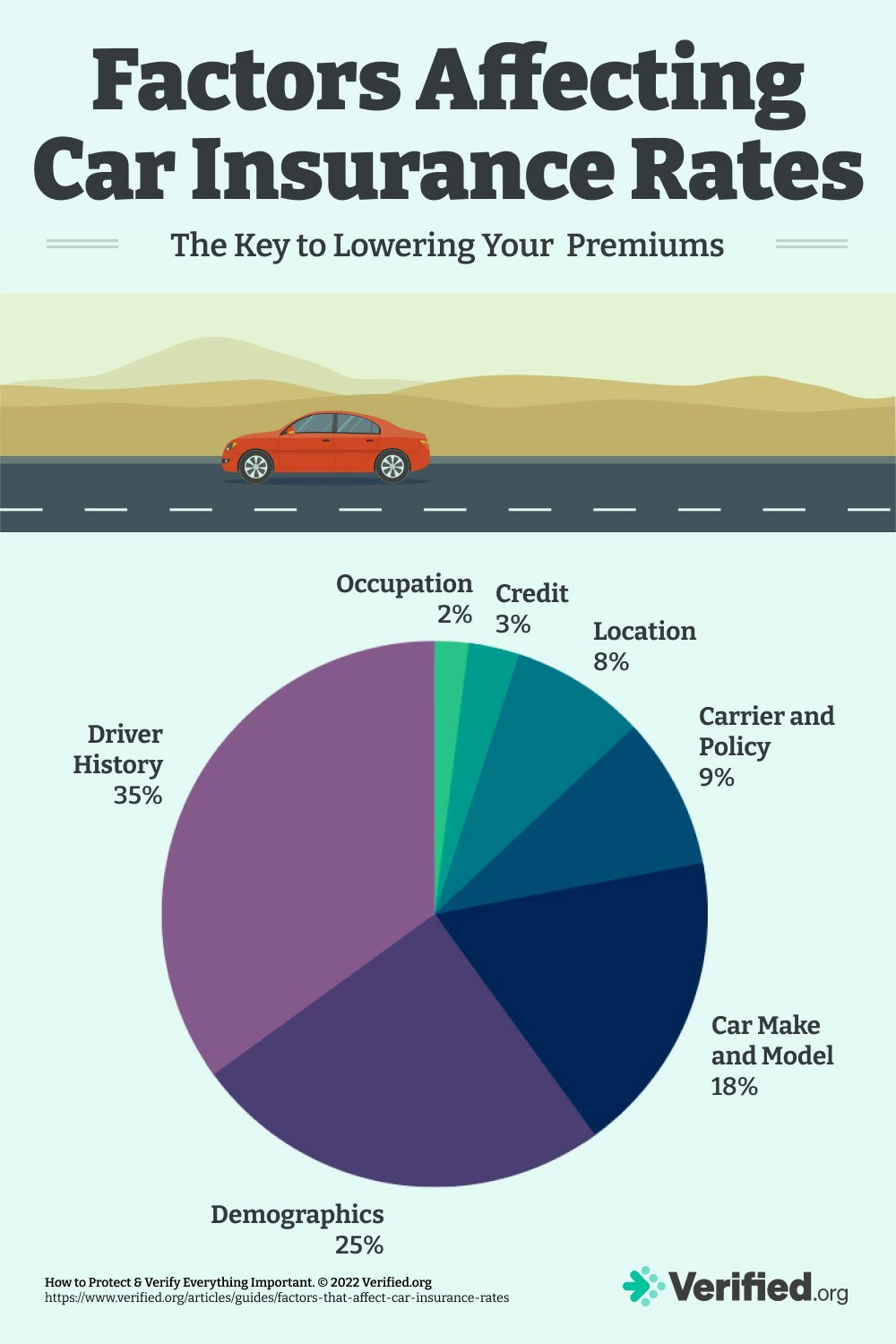

Factors Affecting Your Auto Insurance Rates

The car insurance rate of one driver is typically not similar to the rates of another driver even though they have the same car model. This difference occurs because the car model is not the only factor that affects auto insurance rates. Below are factors that affect auto insurance rates.

1. Car Insurance Coverage Packages

The biggest factor that affects your car insurance rate is your car insurance coverage package. Those with minimum coverage car insurance typically pay lower insurance costs compared to those with full coverage car insurance.

2. Driver’s Age

Age also affects car insurance rates. Car insurance companies generally see younger drivers as reckless drivers. Therefore, they charge younger drivers higher insurance rates.

3. Driver’s Driving Records

Driving records show how good a driver is. Therefore, insurance companies consider those with clean driving records as good drivers. They typically charge these drivers lower car insurance rates.

4. Driver’s Credit Score

Driver’s credit score also affects car insurance rates. Those with bad credit scores pay much higher car insurance rates than those with good credit scores. In some cases, drivers with bad credit have higher car insurance rates than drivers with speeding tickets.

5. Driver’s Location

Another factor that affects car insurance rates is the driver’s location. Car insurance companies generally charge low insurance rates to those who live in rural areas.

How to Find the Cheapest Car Insurance

If you think your current car insurance is too expensive, you may replace it with cheaper car insurance. You can follow the following tips on how to find the cheapest car insurance to find a cheaper replacement for your current car insurance.

1. Search for a Car Insurance Package that Meets Your Needs

Based on the explanation above, the car insurance package affects your car insurance rates. Therefore, the first step you must do in finding the cheapest insurance is to search for a car insurance package that meets your needs.

For example, you don’t need to have a full coverage car insurance package if a liability insurance policy is enough to meet your protection needs. Therefore, you don’t need to spend an extra amount of money on full coverage car insurance.

In addition, you must ensure that the car insurance you buy has minimum coverage limits required by the government. This type of car insurance package is, of course, more affordable than that with higher coverage limits.

2. Compare Car Insurance Quotes

The next trick on how to find the cheapest car insurance is comparing car insurance quotes. Many websites, such as Nerdwallet, Car and Driver, and car insurance company websites, offer you a simple tool to get car insurance quotes.

This tool is easy to use. You only need to fill the boxes of this tool with your zip code and age. After that, you must click the ‘get quotes’ button. With the help of this tool, you can compare car insurance quotes from many insurance companies and select the cheapest auto insurance.

You can also shop around for car insurance packages at an insurance agency. An insurance agent will provide you with insurance quotes for car insurance packages that are suitable for you. Therefore, you can compare them and choose the one that is most affordable for you.

3. Improve Your Driving Records

You must improve your driving records if you want to purchase the cheapest car insurance policy. You can improve your driving records in many ways, such as avoiding speeding, driving under the influence, and getting into accidents.

You should maintain your good driving records for several months before purchasing insurance. After that, you can try to re-check your insurance quotes. You will get lower car insurance quotes if you are successful in maintaining your good driving records.

4. Improve Your Credit Score

Since credit score also affects your car insurance rates, you must improve it if you want to get cheaper auto insurance premiums. You can start improving your credit score by paying your bills on time each month.

In addition, you must reduce your credit utilization rate. After several months of improving your credit score, car insurance companies will find out that you are a low-risk driver based on a credit check. Therefore, you will get more affordable auto insurance rates.

5. Ask for Discounts

You can get cheap car insurance if you ask for discounts. Most car insurance companies offer discounts that can significantly lower your auto insurance rates.

Some discounts provided by these companies are low-mileage discounts, student discounts, and bundling or multi-policies discounts. If you are eligible for the discounts, you can save a large amount of money on auto insurance.

The List of Cheap Car Insurance in the US

Some car insurance companies sell their auto insurance policies at affordable prices. Therefore, purchasing your car insurance from these companies is an excellent solution to save money on auto insurance. Below is a short list of car insurance companies that offer affordable auto insurance.

- USAA: This company offers cheap insurance policies for good drivers and drivers with DUI. The average car insurance premium of this company is $1,421/per year for good drivers. However, USAA products are only eligible for veterans, their families, and those in the military.

- Auto-Owners Insurance: Auto-Owners sells its car insurance products at competitive prices. The average annual rate of Auto-Owners’ car insurance policies is $1,628 for good drivers. Moreover, it offers cheap car insurance for drivers with speeding tickets and at-fault crashes.

- Geico: Geico car insurance is available nationwide. Its average premium is $1,716/year for good drivers. In addition, it also offers low-priced car insurance for young and senior drivers, drivers with poor credit scores, and drivers with speeding tickets.

How to find the cheapest car insurance? You can compare online insurance quotes or offline insurance quotes to find the cheapest auto insurance. In addition, you can lower your car insurance rates by improving your driving records, improving your credit score, and asking for discounts.

Leave a Reply