International health insurance or international medical insurance is providing coverage for routine and emergency healthcare while the policyholder is working or studying abroad for more than a year. This insurance will let you access private healthcare in your residence country.

There is international medical insurance for families, individuals, and also companies that want to provide coverage for employees while those employees work outside the US. Usually, international medical insurance cover for different treatments.

Acute conditions medical treatment, cancer treatment, PET, CT, and MRI scans, repatriation, emergency dental treatment, and other conditions can be covered by cheap international health insurance.

International Health Insurance Benefits

Many insurance companies are offering different plans and also coverage levels for policyholders. The coverage of international medical insurance usually varies across providers. You need to understand what you will get before purchasing any international medical insurance policy.

1. Eliminate foreign healthcare costs

The way to access public healthcare in various countries and the costs you need to pay will be different across the globe. Some countries offer a free public healthcare system but some others will require you to pay part or all of the medical treatment cost.

Foreign countries are not automatically having access to various public healthcare in the new residence country. With international health insurance coverage, you will be more convenient in working or studying abroad because the policy will cover private hospital bills.

In case of emergency, the international medical insurance policy is going to cover the repatriation and transport costs if necessary.

2. Cover your healthcare anywhere

Wherever you go, international medical insurance is going to cover you in many countries around the globe and the cover will not be restricted to only a country. With many insurance policies, you are allowed to choose the most specific area where you are going to be covered.

However, please note that international and travel health insurance will not cover your oversea travel if the goal is to receive medical treatment in another country.

3. Give you more choice

The next benefit of getting international medical insurance is that you will get flexibility in terms of healthcare. You are free to choose the doctor you need to see. Also, you can choose the treatment type and the hospital where you can get the treatment you want.

Moreover, compare international health insurance and you will find plans that will give you an option to get treatment at home. Or, there is even an option to get treatment in another country where you can spend a lot of time if you want to.

4. Include additional cover

Many international medical insurance companies are covering medical repatriation and evacuation to the home country if your residence country cannot provide the treatment you need. You will also get some other optional benefits such as optical and dental cover as well as maternity cover.

International health insurance may also let you increase the coverage level simply by exchanging it for a higher premium. Keep in mind that international medical insurance benefits can vary across different providers. Make sure that you compare different policies to find the best one.

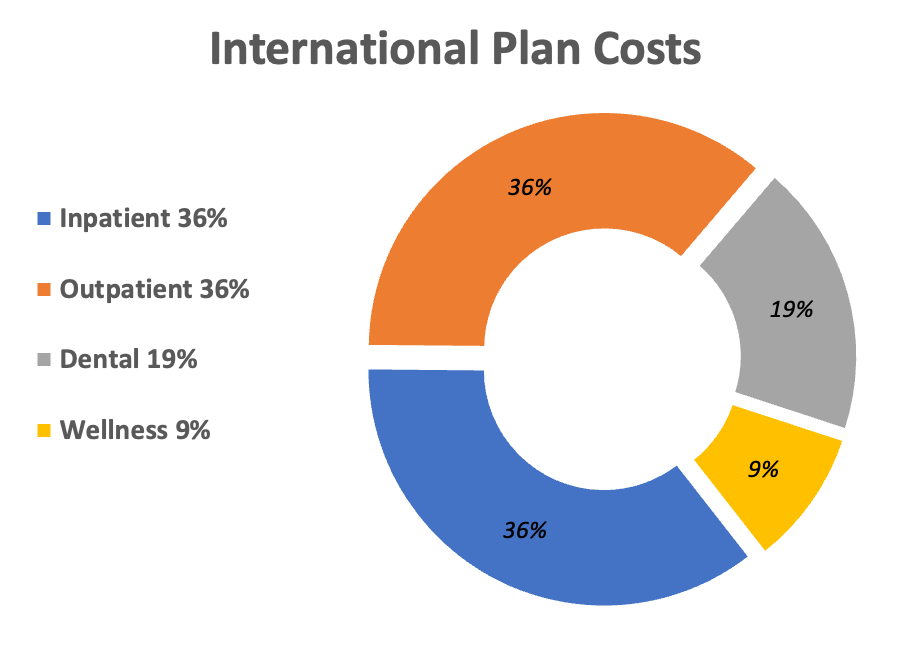

Average Cost of International Medical Insurance

International medical insurance costs can vary, depending on different factors. Mostly, international medical insurance is more expensive than regular health insurance plans in the US. Below are some common aspects that affect the cost of international medical insurance.

1. Your age

The age of those who will be covered by the insurance policy will affect the cost of the policy. Actually, all insurance types are just the same. As you get older, the premium will be higher.

2. The residence country

The country you are about to live in will also affect the premium you should pay. The premium of international medical insurance for US citizens will be higher if you are going to move to a region or country where healthcare is more expensive.

3. Your medical history

Some international medical insurance companies are providing international coverage for any pre-existing condition. However, this is going to make the premium much more expensive.

4. The coverage level

If the international medical insurance policy you are choosing has more options and a higher coverage level, then you will pay a higher premium.

Who Needs International Health Insurance?

International medical insurance is not mandatory. However, this insurance plan will help many ex-pats access the local healthcare system very easily. Knowing that you will be covered if you become injured or ill in a foreign country will make you feel more convenient.

If you can find yourself in the list below, then you need international medical insurance.

- Families and individuals who are relocating permanently to another country.

- Individuals who want to retire abroad.

- Individuals who are working, volunteering, or studying overseas.

- Global businesses and groups.

- Frequent business travelers.

- Multinational employers.

- Remote workers.

Try to look for the best short-term or long-term international medical insurance that meets your own needs. But before buying an international medical insurance policy, learn how it differs from travel insurance.

Is It the Same as Travel Insurance?

International medical insurance is offering protection for the long term when you are living abroad for a year or more. Usually, international medical insurance will cover the policyholder’s routine and emergency medical treatment and healthcare costs.

Travel insurance is something different. It is a plan that offers coverage for a year or less. This plan will only cover accidents and health emergencies that happen during a business trip or holiday. Also, it includes non-medical benefits like coverage for cancellations or lost luggage.

Travel insurance will never cover costs that are related to healthcare as long as it can wait until you come back to the US.

Though international medical insurance is offering a bunch of benefits, many insurance companies are not covering critical illnesses or pre-existing conditions under their international medical insurance. Medical expenses for illness or injury treatment because of alcohol consumption won’t be covered.

Compare some different companies and the international health insurance policies they offer. This is the only way you can figure out which company is providing the best policy for your stay overseas. Make sure that you find one with the premium you can afford and the coverage level you need.

Cheers!

Cheers!

Leave a Reply