Being a worker in certain job fields is not that easy. You might get into hazardous circumstances that could put you in danger. As an employee, worker compensation insurance is such a must thing to have. Both employees and employers should have a plan to secure their medical care.

Each country has its own terms and conditions including the cost to claim worker compensation policy. In Indonesia, they have BPJS Ketenagakerjaan that will cover the need for the healthcare of all employees. Let’s read this article to find out how important worker compensation policy is!

Definition of Workers Compensation Insurance

You might be familiar with the term worker compensation insurance. Some companies put it as their employee’s priority since it can accommodate your medical care. This policy can be used for employees who get into an accident, injury, or death resulting.

In the case of worker compensation policy, there shouldn’t be one who takes the fault. If someone gets an injury in the workplace, it doesn’t mean the employer is the one who should be got the blame.

Nevertheless, an employee can lose their right to their compensation policy if they got into an accident due to drug consumption or alcohol.

How to Claim the Compensation Policy

Before you go to claim your worker compensation insurance, make sure that your company provides the agreement of workplace accidents.

Any injury which happened in the workplace is included in the compensation agreement. Once you find out that your company secured it already, you can claim it as the next step occur.

Additionally, worker compensation insurance works only when you are being an employee. On the day you retired from your job, this compensation policy will automatically be canceled.

Step to Claim the Compensation Insurance

Despite getting help from your company to claim your worker compensation insurance, you have to be clear about the case. You need to include some related documents and hand them to the insurance office. The documents you have to wrap in such:

1. Claim Form for Workers Compensation Insurance

The most important thing you have to hand in is the compensation form. In this form, you might have to fill it with your identity, and which worker compensation insurance you want to apply.

2. The Event Chronology

In addition, this form is used for you to write down in detail about the chronology. The way you get into an accident, which body part might be hurt, and the symptoms after the tragedy. Elaborate on them in as detail as you can in order to get the right compensation.

3. Police Report

Furthermore, the police report is also needed for you to report. The police report can be evidence of the legibility of your case. To get this release, the police probably need to do an interview to get more detailed pieces of information.

4. Other Documents

Aside from those important documents carried out for your application, other documents should be enclosed as well. The documents could be different in each country. Either they are one or two different documents.

Enclosed Document for Worker Compensation Insurance Application

Besides the employee’s responsibility to prepare and include documents for compensation policy application, the employer also has to do it. In order to get compensation approval for the company’s employees, the employer should give a list of their employees.

The list will detailed information about the company profile, employee work type, the whole employee both regular and international workers, and the sum of salary in a year. These files should be ready for application and to complete the required information.

How Much You Should Pay for the Cost?

The cost and payment system for the worker compensation policy is dissimilar in each state. Each country acquires its own control over the law and courts about the worker compensation insurance system.

For example, in Indonesia, 75% of the minimum wage immediately becomes the main basic salary. Likewise, the rest of the 25% will contribute to other work benefits and compensation. So, there is no exact number to pay the monthly fee for this work compensation.

Despite that, in California, up to 40 cents will be contributed for compensation in every $100 for low-risk employees and $33.57 for high-risk employees. Yet, in New York, they secure 7 cents for each $100 for low-risk and for each $29.93 for high-risk employees.

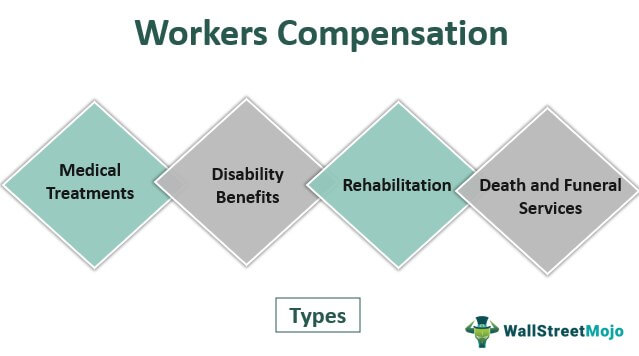

Workers Compensation Insurance Coverage

Considering each state’s law and courts of the worker compensation policy, there are also some differences in coverage benefits. Workers who live in Indonesia and California might experience dissimilar treatment of this policy. The number of its cost also takes the advantages outcome.

Nevertheless, the beneficial coverage of this term depends on the type of accident. Injured workers will get injury necessary treatment and medicines. The cost also will be different among the type.

Some states will provide salary replacement benefits to injured workers due to work-related accidents. As well as for rehabilitation requirements and the benefits of death resulting from injury.

The three main benefits are used in almost all of the country. Yet, in Texas. they would exclude some benefits. In addition, some countries such as Indonesia have another benefit for worker compensation insurance.

Indonesian policy of worker compensation includes some benefits for retired employees and annual pay. They also have THR (Tunjangan Hari Raya) as compensation for Eid Fitr’s leave.

Is Workers Compensation Insurance Worth It?

Insurance is one of the important things in life that we should have at least. With insurance, there will be a lot of helps for our needs in life. Worker compensation insurance is one of them. It especially pointed to all of the employees around the world applying this form.Come along with beneficial advantages, worker compensation insurance can secure your medical covers in the workplace. If you are getting into an accident, you don’t need to fully pay for medical care. Your compensation insurance will do it for you instead. So, make sure to your company that you have your own compensation!