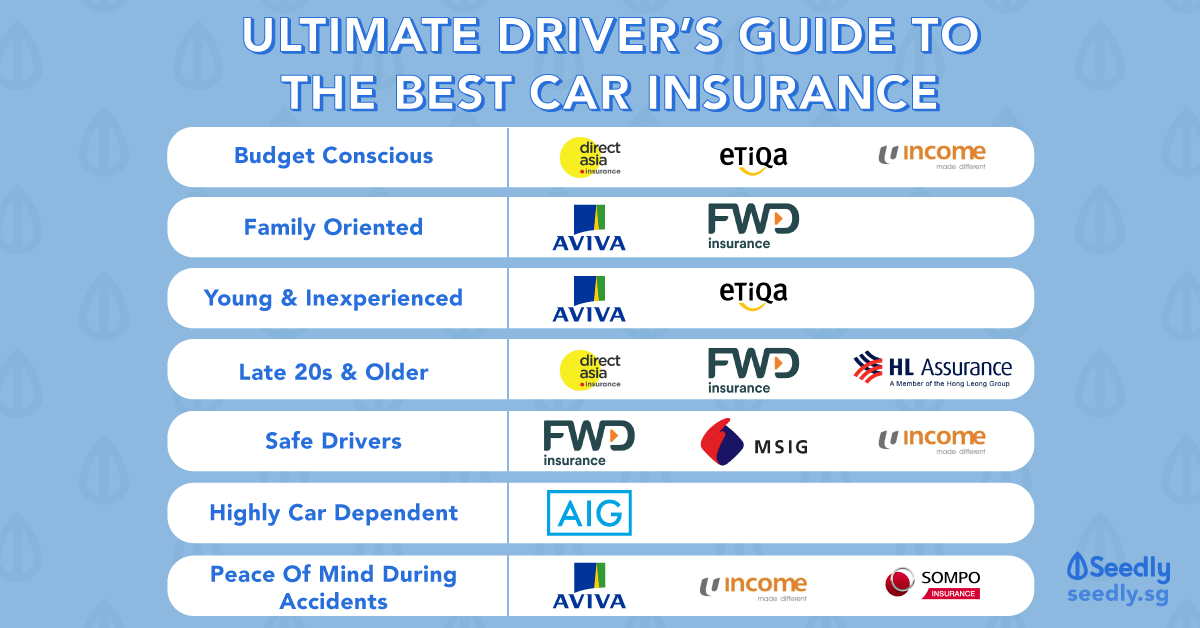

It is crucial to insure your car with the right plan for your budget and car type. In Singapore, there are some good deals that you can choose to protect your car. Among the options, you have to see which car insurance company in Singapore fits your needs.

Top 10 Car Insurance Company in Singapore

1. MSIG

If you have a tight budget, then MSIG is the right option for you. Although the price is low, this company has a good reputation with more than 30 workshops in Singapore. The protection is up to $100,000 and the price of the insurance is starting from $825 per year.

The best thing you can get from MSIG company is the replacement of the new car. This offer is great if you get in an accident and your car is irreparable. They have good deals with many vouchers to discount the cost of petrol.

2. FWD Insurance

FWD Insurance is the most popular car insurance company in Singapore. The premium has the best discount in the market. You can purchase this insurance online. This company also offers a lifetime guarantee of NCD for about 50%. The cost starts from $794 per year.

This company needs the name of the drivers who use the car, so they get insured. This plan is not best if you have a car rental. If you lose your car, FWD will give you a courtesy car for up to 3 months. When the car is repaired, FWD gives you an allowance of about $80 per day for ten days.

3. SingLife with AVIVA

This company is well-known in Singapore because it has a lot of promotional rates. The cost per year is higher than others, which is $1,311. Even so, SingLife is related to more than 30 workshops in Singapore. You will get the best promo if you are a civil servant of NSmen.

The Singapore car insurance applies to inexperienced drivers, but they should be at least 24 years old. The best feature of this insurance is e-assistance in case you face an emergency case. The discount is up to 23% sometimes which makes it worth buying.

4. Allianz

Allianz has a lot of plans to offer. Among the insurance companies, Allianz is the best for value for money. The cost per year is only $650, but it covers many things including damage to third parties and injury to third parties. It also gives a lifetime warranty for repairing the car.

Allianz gives a promo. The company can assist the roadside 24/7 as their complimentary service. If the car suffers from damage that is unfixable, Allianz can warranty to replace the car as long as it is less than two years. Another feature to enjoy is excess flexibility for all clients.

5. AIG

This is the insurance that will cover many kinds of collision cases. It gives the best protection which costs about $1,100 per year. AIG gives many vouchers for up to $200 for new clients. The premium is low compared to others that also offer collision protection.

The company offers a unique feature where drivers above 30 and 40 can pay lower premiums. The coverage from this company is up to $5,000,000. The coverage for injury and death of third parties is unlimited. It is worth the money for Singaporeans.

6. SingTel Car Protect

This insurance is also well-known in Singapore and most Singaporeans are familiar with SingTel branding. The premium is very affordable because it is only about $850 per year. The coverage from this car insurance company in Singapore is also very comprehensive.

SingTel insurance’s application is simple and you can submit the insurance registration online. The authorized drivers and passengers could get coverage up to $50,000. When you buy the premium, you can get vouchers for petrol up to $200 by purchasing the plan.

7. Etiqa

Etiqa car insurance is the best option for young drivers. The price is very affordable, only about $850 per year. The purchasing process and how to claim the insurance is very simple. Tiqa can pay out the clients only in 30 minutes.

When the car is in the workshop, Etiqa will give the clients an allowance of about $50 per day as long as the car is in the workshop. However, Etia gives a low age limit where the application is only applied to drivers more than 24 years old.

8. Income – Drivo

If you drive an electric vehicle in Singapore, it is better to have Income Drivo as the insurance. This is specialized for the EV only. The insurance will cover some brands from Tesla, Kia, BMW, Mini, BYD, Audi, and Renault. It starts from $1,200 per year. However, this insurance doesn’t have much promo.

9. Income Car Insurance

This insurance company is reputable among insurance companies in Singapore. They offer assistance on the roadside, so they can help anytime. This insurance is the best option if you are looking for one which can help in emergency cases. They also have an NCD protector offers.

If you are driving in West Malaysia, Income Car Insurance will also give you insurance. Claiming the insurance will apply to this region. The cost of the insurance is starting from $1,000 per year. There is an allowance of about $50 per day when your car is repaired. It connects to 30 authorized workshops.

10. HLAS Car Protect360

This insurance is quite expensive compared to others, but it is because the insurance company is coming from a reputable group in Singapore, Hong Leong Group. This is the best option to choose from because they connect to many authorized workshops in Singapore.

The price of the plan is starting from $1,340 per year. If you are a new member or a loyal member, there are some discounts to offer up to 25%. They have their own workshops, so the premium still can cover it. Another feature of this insurance company is 24/7 roadside assistance.

The list of car insurance company in Singapore above is the best option to choose from. It is very important to have car insurance if you are driving in Singapore. The cost per year is cheap and they give the best protection for the car, driver, and passengers.

Leave a Reply