Some people think life insurance is expensive so they choose not to purchase it. However, life insurance rates are not as expensive as you think. You can compare life insurance quotes on particular websites to find out how much life insurance costs and find the cheapest quote.

Once you find the most affordable life insurance rate, you can start the purchasing process. However, choosing the most affordable policy is not enough. You must also make sure that the coverage amount of your life insurance can provide financial security for your loved ones when you pass away.

The Benefits of Purchasing Life Insurance

Purchasing a life insurance policy means you agree to pay a premium to the life insurance company. In return for the premium you pay, the insurance company will pay a death benefit to your beneficiaries when you die.

However, some policies also allow you to withdraw the death benefit while you are still alive if you suffer from serious health conditions. Moreover, other policies let you borrow against it or withdraw it to pay for particular needs, such as college tuition.

However, the acts above will affect the amount of death benefit your beneficiaries will get. Leaving this money to your beneficiaries will help them to:

- Pay off debts;

- Pay for your final expenses;

- Pay the children’s college fees; and

- Pay for daily expenses.

Types of Life Insurance

There are two types of life insurance. However, one of them has several subtypes. You must know what these different insurance types entail before purchasing one of them. Therefore, you know what to expect from it.

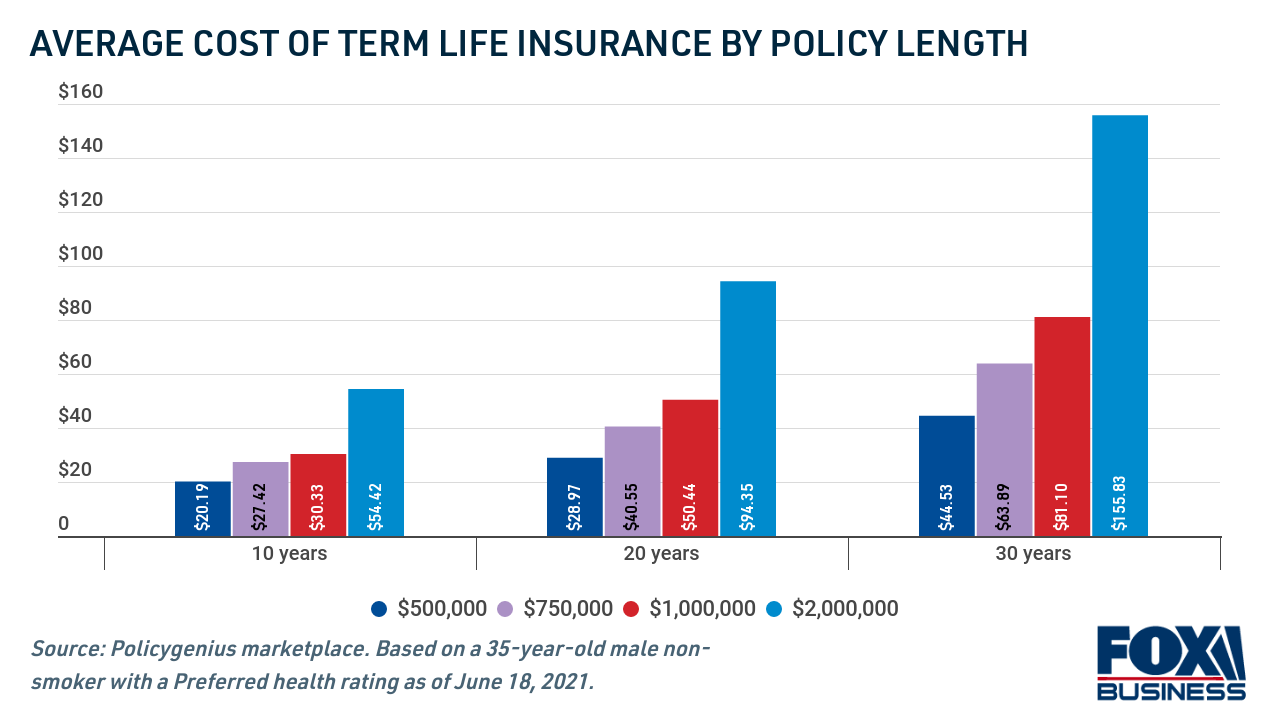

1. Term Life Insurance

Term life insurance covers you for a set term, e.g., 10, 20, or 30 years. The life insurance company will pay the benefit if you die during this set period. Term life insurance quotes are lower than those of other life insurance types.

However, it is essential to note that the longer the term, the higher the insurance quotes are. Moreover, the insurance company will not pay the benefit to your beneficiaries if you are still alive at the end of the period.

2. Permanent Life Insurance

This type of life insurance covers you for life, providing you pay for the premiums for as long as you live. Companies that offer permanent life insurance policies will give you a guarantee that your beneficiaries receive the benefit when you pass away.

However, the quotes for permanent life insurance are higher than term life quotes. Moreover, some permanent life insurance types have an investment component that builds over time, called cash value. You can cash it out or borrow against it if you need to.

Permanent life insurance types are as follows.

- Whole Life Insurance: Whole life insurance requires you to pay non-flexible premiums. Purchasing this insurance offers a death benefit. It will also allow you to have a lifetime asset in the form of cash value that you can access when you need to.

- Universal Life Insurance: This type of permanent life insurance offers cash value and lifetime protection. However, it has flexible premiums. Therefore, you can adjust the premiums based on your financial conditions or life circumstances.

- Indexed Universal Life Insurance: Indexed life insurance is similar to universal life insurance. However, its cash value has higher growth potential because the interest grows based on underlying bonds or stock indexes.

- Variable Life Insurance: Variable life insurance offers a death benefit, cash value, and a flexible premium option. When you buy this insurance, you have an opportunity to invest your premium in separate accounts, e.g., bond fund and stock fund.

How to Get a Life Insurance Quotes

You can get life insurance quotes from various websites. These websites have an insurance quote calculator that will help you find insurance quotes. Some of them will require you to fill in several boxes, such as age, zip code, term, and the amount of coverage you want.

After filling these boxes, you must tap on the ‘get a quote’ button. Other websites have a ‘compare quotes’ button. Therefore, you can compare quotes and find the most affordable insurance quote.

Average Term Life Insurance Rates by Age

Below are examples of average term life insurance rates by age you must pay if you choose to have a $500,000 coverage amount with a 20-year term.

| Insurance Company | Name of the Term Life Insurance Term | Annual Cost for | Annual Cost for | ||

| Female Age 40 | Male Age 40 | Female Age 30 | Male Age 30 | ||

| Nationwide | YourLife GLT | $315 | $370 | $230 | $265 |

| American General | Select-a-Term | $290 | $345 | $195 | $230 |

| Pacific Life | PL Promise Term | $289 | $340 | $194 | $229 |

| Banner/Legal & General America | OP Term | $288 | $355 | $193 | $228 |

| State Farm | Select Term Life | $390 | $465 | $255 | $330 |

| Principal | Term with Conversion Extension | $312 | $368 | $211 | $250 |

Comparisons of Term Life Insurance Costs and Whole Life Insurance Costs per Month

Term life insurance rates are more affordable than whole life insurance rates. Below is the comparison of monthly insurance costs of both insurance types.

| Policyholder Age and Gender | Whole Life Policy Monthly Costs ($500,000 coverage) | Term Life Policy Monthly Costs (a 20-year term with $500,000 coverage) |

| 30-year-old female | $353 | $18 |

| 40-year-old female | $507 | $26 |

| 50-year-old female | $753 | $57 |

| 30-year-old male | $395 | $22 |

| 40-year-old male | $565 | $31 |

| 50-year-old male | $848 | $73 |

How Much Life Insurance Coverage Amount One Must Have

Various factors affect life insurance quotes. One of them is the amount of coverage. You can get lower quotes, but the death benefit you would leave for your dependents may not be enough to pay for your final expenses and their daily expenses.

Therefore, you must ensure that you buy a life insurance policy with enough amount of coverage. Below are tips to determine the life insurance coverage amount.

- Determine how many years you plan your beneficiaries to be covered after you pass away. Multiply it by your yearly income.

- Add up college fees, final expenses, and mortgage or other long-term debts.

- Subtract any assets or funds you currently have that your beneficiaries can use to cover those expenses.

Comparing life insurance quotes is essential to do before you purchase a life insurance policy. From this comparison, you can purchase the most affordable insurance policy. However, you must make sure that the policy you buy offers enough death benefits for your beneficiaries.

Leave a Reply